The Definition Of A Frozen Bank Account

An individual may hold a bank account for various purposes. One of the objectives of holding a bank account is to keep money at a secure location. There are situations where an…

Read more

An individual may hold a bank account for various purposes. One of the objectives of holding a bank account is to keep money at a secure location. There are situations where an…

Read more

SME loan is a type of advance availed by small and medium scale enterprises to cater to their financial requirements. The motive behind this step is to propagate the growth…

Read more

Each credit card comes with a set of benefits and tends to increase an individual’s purchasing power via the line of credit made available. However, individuals with credit cards are…

Read more

Diwali is knocking on the door, and it is the best time to buy smartphones and other appliances. If you want to know about the benefits of buying branded smartphones…

Read more

Fixed deposits (FD) and recurring deposits (RD) are the most popular investment tool in India because of easy accessibility. They are both quite easy to understand as well, when compared…

Read more

Delhi has a vibrant economy, which makes it one of the most expensive cities to live in the nation. Its per capita income has risen by over 10% from 2017–18…

Read more

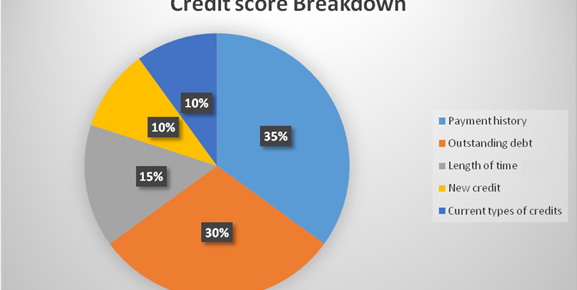

If you are in search of a personal loan, then the first thing your well-wishers will tell you is to ensure a good credit score. You might even be told…

Read more

Real estate investments have gained prominence among the investors in recent times. It can earn you good returns and provide a passive income in the future. Valuation of the property…

Read more

In the market, medical billing is a process that is much in the limelight these days. There are ample hospitals who hire the experts of this process to settle their…

Read more

Purchasing a home is one of the most crucial financial decisions that an individual makes in his/her lifetime. Over the past few decades, home purchase has become more feasible for…

Read more