What Does your Credit Score Comprise Of?

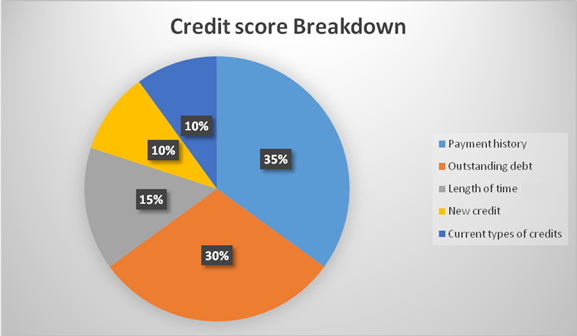

If you are in search of a personal loan, then the first thing your well-wishers will tell you is to ensure a good credit score. You might even be told by them to wait until you have a good credit score to apply for a loan. If you are a person with a slight knowledge about the credit score, then you might be aware of how much it affects your chances of getting a low-interest rate and loan approval. This is because credit scores are one of the major aspects with which a lender determines your credit-worthiness and repayment capacity. If you do not know what constitutes a credit score, have a look at its breakdown which will help you understand the process of credit score in detail.

35%- Payment history

Your payment history makes up the majority of your score. This is because the main reason a lender wants to check your credit score is to understand your repayment capacity and punctuality. The number of bills you have paid, bankruptcy if any and the number of bills that were sent out for collection are some of the many things affecting this score. Also, if you have any negative history, then the time of its occurrence also plays a crucial role in your score. Your overall score will be affected on the basis of the repayments and punctuality.

30%- Outstanding debt

Another major chunk of your score is decided by your outstanding debt. It might include points like the number of credit cards that have crossed your adequate limit and how much you owe for your loans. It is always advisable to keep the credit card balance less than 25% of their limit. Keep in mind that your credit score is inversely proportional to the number of cards you have and their limits.

15%- Length of time that the borrower had credit

Some lenders do not agree to offer a low-interest rate to borrowers who have never taken a loan before nor have a credit card. In such cases, the borrower might be worthy and punctual but doesn’t have enough sources to prove that. Therefore, the lender might not be able to trust the borrower owing to null credit history. This is what this 15% of the credit score caters to. The slot is dedicated to the length of time you have had credit. Your credit score will be higher if you have a long-established credit. A longer duration with good history tells the lender that you are not a risky borrower. It also sheds light on your future repayment actions.

10%- New credit

This is a small percentage but doesn’t fail to affect your score. Your score will get affected negatively for a short time if you open a new credit account. Any hard inquiries on the credit card (in the past year) is also penalized under this category.

[If you do not know what a hard inquiry is or how it is different from a soft inquiry, then here it is. A soft inquiry is when you check for your own score. It does not affect your credit score. However, a hard inquiry has an immense effect on your score. Hard inquiries are carried out when the lender checks your credit score. Therefore, the higher the number of loans or credit cards you apply for, the higher will be the number of hard inquiries done.

10%- Types of credit that the borrower has currently

This category sheds light on the type of credit you have at the moment. If you have a high score in this category, it is an indication of your experience with different types of credit accounts.

You don’t need to worry if you have a low credit score and are in need of finance. You can always approach a reputable P2P lending solution where you get funding within 2 days. But as credit score is not the only factor which they look for in a borrower, you can get personal loans easily from them even if you do not have a good credit score.

Akshay Sharma

Latest posts by Akshay Sharma (see all)

- Get a Personal Loan Without Salary Slip in India – A Practical Guide - July 14, 2025

- Make Raksha Bandhan Special Abroad: Send Rakhi to the UK, Canada, or Australia with Gifts - July 8, 2025

- New Country, Same Care: Start Your Nursing Journey in Germany - July 7, 2025

- YOUR NEXT VIRAL BOHO LOOK STARTS WITH GREEN KYANITE RINGS - July 2, 2025

- How to Apply for Partner Visa 801: Full Guide for 2025 - June 26, 2025

- Challenges Faced By Professionals at Construction Consulting Firms

- Excel Yourself With the Help of These Tips