What You Should Know About Applying Online for A Business Loan

Whether you are a start-up or an established business, the fact of the matter is that you only have a specified amount of funds to infuse into your business to get it up and running. Inevitably, after a particular time, you would require exploring external sources of finance to meet your monetary requirements. Earlier, when the banking sector was experiencing a boom, it was very easy for companies to get finance for their various requirements in the form of Overdraft limit, Working capital limits, Term Loan, CC Limit, Bills Receivables etc.

In the recent past, due to the heavy turmoil that the banking sector has been going through it has become difficult for business owners and managers to get funding from banks to meet their expansion as well as working capital needs. Banks now have more stringent criteria that you will need to fulfil before your application is considered for a loan.

What Happens with Online Loan Applications

With the rapid influx of technology in all aspects of society, banking and finance sector has also undergone a host of changes. Gone are the days when you had to run around a bank trying to find out the fate of your loan application. Now you can easily apply SME business loan online through various Online Loan Companies that offer you the option of applying for Small Business loans Online.

These companies have fully functional websites where you can easily access information about various loan products available and then also check your eligibility for the same. When you are satisfied with your eligibility only then, you can proceed ahead with filling your Loan Online Application form and then take the proceeding further from thereon. You must remember that making multiple applications might also hurt you, as every time you apply for a loan, the lender pulls your CIBIL score. If there are so many queries reflecting on your CIBIL score in a short duration, it could jeopardise your prospects significantly.

After you have applied for a business loan online, you will receive a call back from the representative of the financial institute, who will then fix up an appointment with you. Then the company representative will visit you to understand your requirements and collect the documents. They will ask for more documents from time to time, which you should readily provide. Once they have established your eligibility and satisfied about your repayment ability, they will sanction the loan and disburse the amount to your account.

Things to know before you apply with Online Loan Companies

As we have discussed above that banks and financial institutions have now made their eligibility criteria more stringent, you should understand the below-mentioned facts before you proceed to apply for SME business loan online by filling the Loan Online Application Form, to improve your chances of getting small business loans online: –

-

Evaluate your Credit Score: – When you will apply for a business loan online, the lender will, first of all, check your credit score. If your credit score on CIBIL is 750+, only then would they consider your application. So rather than facing the problems, later on, it is advisable that you pull out your own credit score and check. If it is above the prescribed threshold, all would be easy for you. If it is below 750, then it is better if you wait for some time and work towards improving your credit score.

-

Assess your eligibility: – Lenders will assess your eligibility based on your past performance and future projections. So, you should sit down with the finance and accounting personnel of your company and carefully draw up the analysis. This will help you assess your financial standing as well as understand your financial requirements. When you have these figures in hand, you can proceed ahead with applying for the business loan with much confidence as you know how much you want and how much you are eligible to get.

-

Assess your Cash Flow: -When you apply for a business loan online, lenders also pay considerable importance to your business’s cash flow. It is essential for them to know if your company would be able to generate enough cash to repay the monthly EMI’s. So, it is advisable that you assess your cash flow to understand your repayment capacity and also how much interest you can service. Then only proceed ahead with the loan application.

-

Registration with statutory bodies: – When you apply for a business loan online, it is required that your company is duly registered with the regulatory authorities and has necessary licenses such as GST, VAT, CST, ESI, PF etc. IF you do not have these registrations, do get them done otherwise your application would not be processed by the lender.

-

Tax Returns and Payment: -You should know that no business loan application is processed without a huge list of documents. You must keep all your financial documents ready. If they are not prepared or any statutory dues are yet to be paid, you should pay them immediately. Prepare a file of all the relevant KYC, Financial, Banking and Taxation documents ready and get multiple copies photocopied. This will save you a lot of time when it comes to actual processing of the loan.

As you may have heard “Well begun is half done”. So, you should understand all the aspects of seeking small business loan online before you proceed ahead to enhance the prospects of you getting a loan.

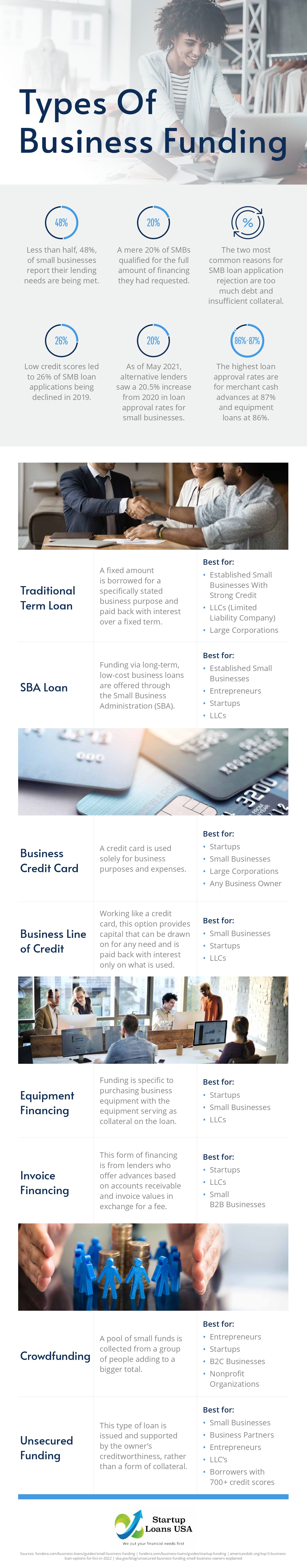

Infographic provided by Startup Loans USA, a business startup loans company

Author Bio:

Rahul Setia works at Ziploan.in, RBI registered NBFC as AVP Digital Marketing. Rahul enjoys creating innovative marketing strategies and is an expert at website data analysis. He is passionate about blogging and frequently shares his extensive knowledge through guest posts on different portals. Rahul has done his bachelors in Information Technology from Gurgaon.

Rahul Setia works at Ziploan.in, RBI registered NBFC as AVP Digital Marketing. Rahul enjoys creating innovative marketing strategies and is an expert at website data analysis. He is passionate about blogging and frequently shares his extensive knowledge through guest posts on different portals. Rahul has done his bachelors in Information Technology from Gurgaon.

Akshay Sharma

Latest posts by Akshay Sharma (see all)

- Best Single Door Fridge Models Of 2025 Features, Energy Ratings & Price Guide - December 22, 2025

- 5 Critical Things You Must Know for Professional Custom Badge Quality: An Expert’s Guide - November 3, 2025

- Are You Using a Loan Calculator for Second Hand Car Rightly? - October 13, 2025

- Round Steel Tanks: Long-Term Solutions for Water Storage - September 19, 2025

- Embrace the Culture: Syna World Hoodie and Syna World Tracksuit UK - September 13, 2025

- Everything You Need To Know About Hedge Trimming

- Moving to New York? Don’t Make These Five Common Mistakes.